Dubai Real Estate Emerging as a Prime Investment Hub Amidst Global Uncertainty

A recent UBS report reveals that Dubai’s real estate market is rapidly becoming a preferred investment choice for global investors, driven by remarkable growth and stability. In August alone, the market experienced a 40% surge in sales value, with transaction volumes soaring to $12.9 billion. This notable increase underscores the growing appeal of Dubai as a secure destination for long-term investment.

Growing Demand and Investor Confidence

Kashif Ansari, CEO and co-founder of Juwai IQI, highlighted the findings from the UBS report, emphasizing the extraordinary demand for real estate in Dubai. He stated that Dubai has emerged as a safe haven for savvy investors with a long-term outlook. Ansari’s outlook on Dubai’s property market remains optimistic, forecasting significant growth potential up to 2030 and beyond.

Prime Areas for Investment

According to Ansari, several key areas in Dubai are particularly attractive for property investments due to their high growth potential and strong investor interest. These areas include:

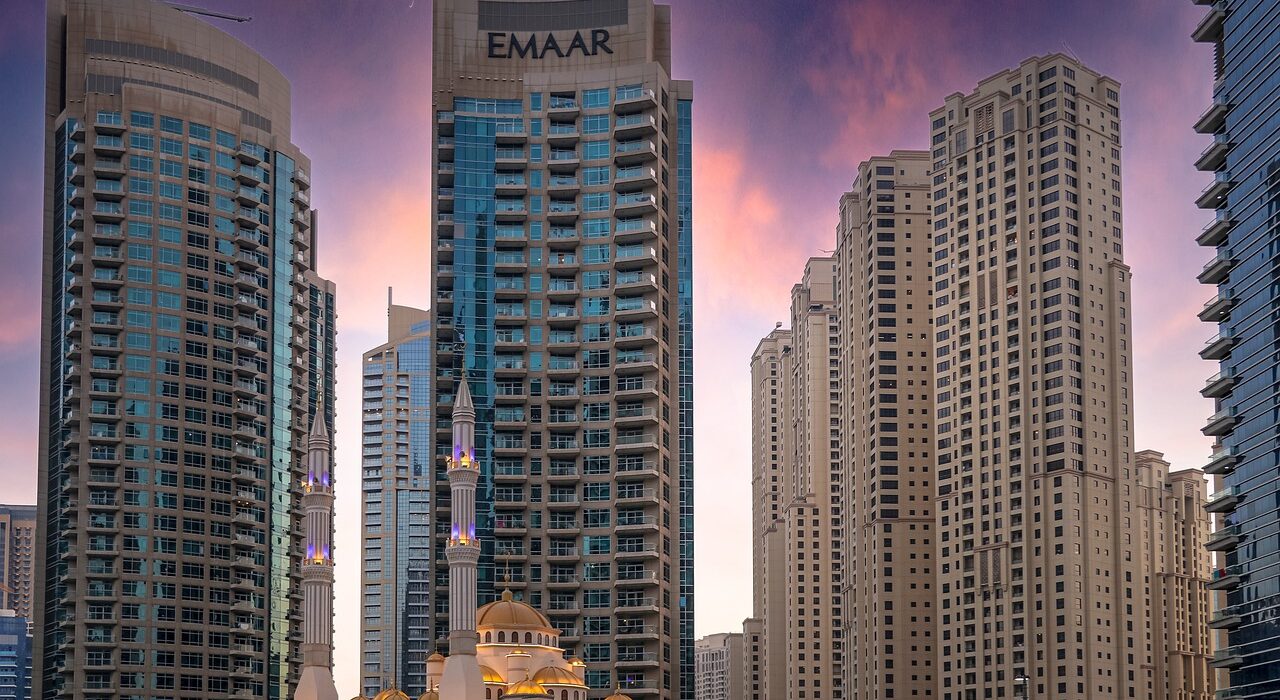

- Dubai Marina

- Jumeirah Village Circle

- Downtown Dubai

- Palm Jumeirah

- Business Bay

- Dubai Creek Harbour

- Dubai Hills Estate

- Arabian Ranches

In August, Business Bay stood out with the highest single transaction recorded at AED 139 million, reflecting both investor confidence and the growth potential of this premium location.

A Safe Bet in Uncertain Times

Ansari further explained that global economic uncertainty is likely to push more investors toward Dubai’s real estate market, which is poised for continued capital appreciation and robust rental yields. He predicted that by 2030, Dubai’s real estate sector could surpass those of established global cities like Singapore and Hong Kong, becoming a major hub for international investors seeking to preserve wealth.

A Global Magnet for Investors

Looking ahead, Ansari is confident that Dubai will attract substantial investments from regions such as Europe, the UK, the USA, India, Pakistan, and China. He emphasized that Dubai’s real estate is becoming a “new global currency” for investors looking to safeguard their assets in a stable and growth-oriented market.

Conclusion

As Dubai’s real estate market continues to demonstrate resilience and growth potential, it is clear why global investors view it as a trophy investment. With key areas offering high returns and the city’s position as a global financial hub solidifying, Dubai remains a top choice for those seeking a stable and promising investment environment.

This summary is based on insights from the UBS report and statements from Kashif Ansari, CEO and co-founder of Juwai IQI, as reported in the original article.