Investing in Dubai’s Green Building Revolution: Opportunities for Global Investors

As Dubai continues to lead the way in architectural innovation, its commitment to sustainability has become increasingly prominent. The city is rapidly evolving into a hub for green buildings, offering global investors, particularly from the UK and Singapore, a chance to invest in eco-friendly real estate developments. This trend aligns with the city’s broader goals, such as the Dubai Clean Energy Strategy 2050, which aims to produce 75% of its energy from renewable sources by 2050.

Growth of Sustainable Real Estate in Dubai

Over the past decade, Dubai has shifted its focus toward environmentally sustainable construction, driven by the global demand for green real estate. The city’s developers are increasingly incorporating features like energy-efficient systems, water conservation technologies, and sustainable building materials into new projects. Key initiatives like the Dubai Green Building Regulations mandate that all new buildings meet stringent sustainability criteria, ensuring that energy and water efficiency are at the forefront of design.

Benefits for UK and Singaporean Investors

Investors from the UK and Singapore have much to gain by focusing on Dubai’s green building market. These developments offer long-term cost savings due to reduced energy consumption and lower operating expenses. As tenant demand for eco-friendly spaces increases globally, properties adhering to green standards also tend to see higher occupancy rates and rental yields, creating an attractive investment opportunity.

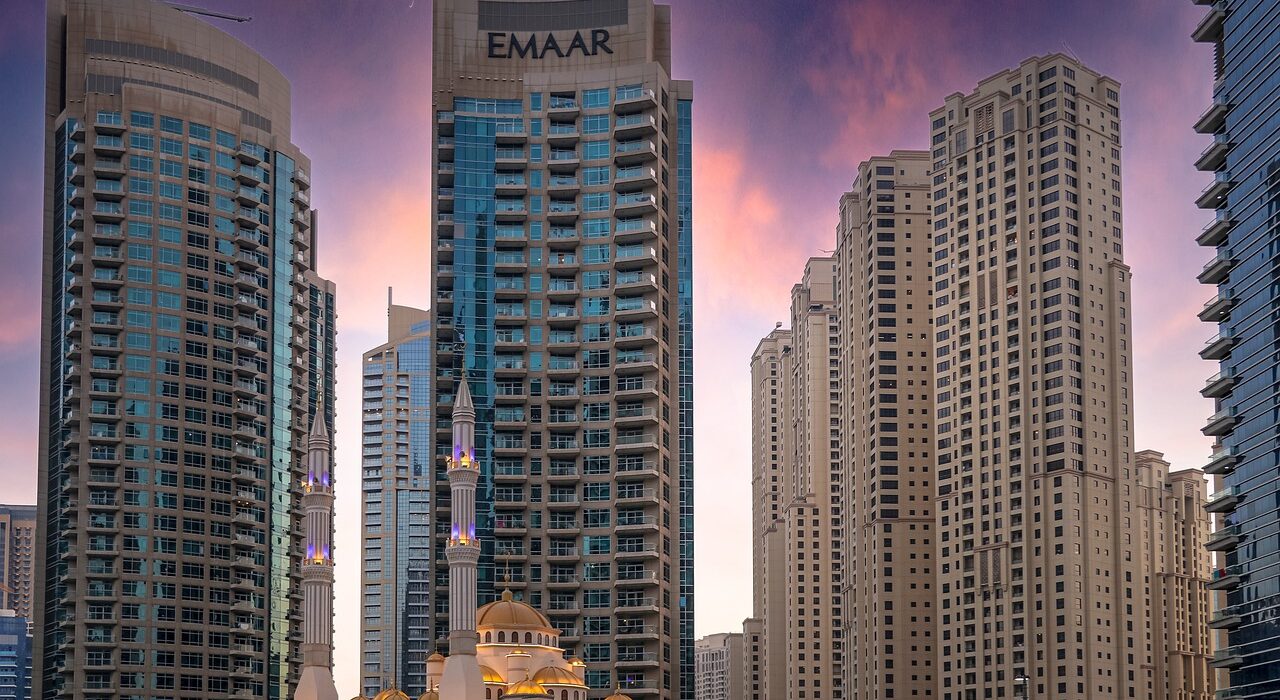

Moreover, Dubai’s transparent real estate regulations and government incentives make it a safe and stable market for foreign investors. With the rise of sustainable developments in premium areas like Downtown Dubai and Dubai Marina, green properties are not only environmentally responsible but also promise solid returns on investment.

Key Areas of Opportunity

The most promising areas for green investment in Dubai include upcoming projects in regions like Meydan City, Dubai South, and the Dubai Urban Tech District. These locations are seeing an influx of sustainable real estate projects, driven by Dubai’s ambitious 2040 Urban Master Plan, which emphasizes green urban development.

Capitalizing on the Trend

For investors, the opportunity lies in both residential and commercial properties, with a particular focus on luxury eco-friendly developments. Green buildings, with their emphasis on sustainability and innovative technologies, promise to outperform traditional properties in terms of both rental returns and long-term appreciation.

As Dubai continues to prioritize environmental sustainability, the green building trend offers UK and Singaporean investors a unique opportunity to capitalize on a growing market while contributing to a more sustainable future.

Conclusion

In conclusion, Dubai’s real estate market continues to set new benchmarks with its emphasis on sustainability and eco-friendly developments. As the city aligns itself with global trends, sustainable Dubai is becoming a leading example of environmental responsibility in real estate. The increasing demand for green buildings, driven by both investors and consumers, ensures that Dubai remains a top destination for innovative and eco-conscious developments. The Dubai property market is poised for continued growth in 2025, with sustainability playing a key role as government policies and initiatives further promote Dubai’s environmental sustainability.

Looking ahead to 2025, we can expect to see even more integration of green technologies, smart home systems, and energy-efficient solutions within both residential and commercial developments. Dubai’s commitment to sustainability is not only helping to shape its skyline but also attracting international investors seeking long-term, environmentally responsible investments.